Free Bitcoins 4U

Free Bitcoins 4U

- Rabbit coin

- How to convert btc to bnb in binance

- Million worth bitcoins

- Ravencoin crypto

- How to buy cumrocket cryptocurrency

- Trending crypto

Btc market cap

How to Buy XRP

The market cap of Bitcoin (BTC) is a widely discussed topic in the cryptocurrency community, as it is often seen as a key indicator of the overall health and value of the digital asset. In order to gain a better understanding of BTC market cap, it is important to explore a variety of perspectives and analyses. Below are three articles that delve into different aspects of BTC market cap, offering insights and information that can help shed light on this complex subject.

The Importance of BTC Market Cap in the Crypto Ecosystem

The market capitalization of Bitcoin (BTC) plays a crucial role in the overall cryptocurrency ecosystem. As the pioneer and most dominant cryptocurrency, BTC market cap serves as a key indicator of the health and performance of the entire crypto market.

Currently, Bitcoin holds the largest market cap among all cryptocurrencies, accounting for approximately 45% of the total market cap of the entire crypto market. This dominance is significant as it reflects Bitcoin's status as the most widely recognized and accepted digital asset. Moreover, BTC market cap influences investor sentiment and market trends, acting as a benchmark for other cryptocurrencies.

The market cap of BTC also impacts the trading volume and liquidity of the crypto market. With a higher market cap, Bitcoin tends to attract more institutional and retail investors, leading to increased trading activity and liquidity in the market. Additionally, BTC market cap affects the valuation of other cryptocurrencies, with many altcoins often following Bitcoin's price movements.

In conclusion, the importance of BTC market cap in the crypto ecosystem cannot be understated. It serves as a vital metric for assessing the overall market trends, investor sentiment, and performance of cryptocurrencies. Understanding and monitoring BTC market cap is essential for anyone involved in the crypto space.

Analyzing the Factors Influencing BTC Market Cap

Bitcoin, the world's first cryptocurrency, has been a hot topic of discussion among investors and financial analysts. As its market cap continues to fluctuate, many are eager to understand the factors that influence its value. There are several key elements that play a crucial role in determining the market cap of Bitcoin.

-

Supply and Demand: One of the most significant factors affecting Bitcoin's market cap is the basic economic principle of supply and demand. As the supply of Bitcoin is limited to 21 million coins, any increase in demand can drive up its market cap.

-

Regulatory Environment: The regulatory environment surrounding Bitcoin can also impact its market cap. Positive regulations can boost investor confidence and lead to an increase in market cap, while negative regulations can have the opposite effect.

-

Institutional Adoption: The level of institutional adoption of Bitcoin can have a significant impact on its market cap. As more institutional investors enter the market, the demand for Bitcoin increases, driving up its market cap.

-

Market Sentiment: Market sentiment plays a crucial role in the valuation of Bitcoin. Positive news and developments can lead to a surge in investor confidence, resulting in an increase in market cap.

-

Technological Developments: Technological advancements in the Bitcoin network, such as improvements in scalability and security,

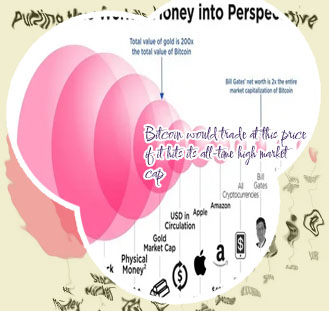

Comparing BTC Market Cap to Traditional Financial Markets

Bitcoin (BTC) has been making waves in the financial world with its meteoric rise in market capitalization. Many people are comparing the market cap of BTC to traditional financial markets like the stock market and forex.

One of the key differences between BTC and traditional financial markets is the decentralized nature of Bitcoin. Unlike traditional markets that are heavily regulated by governments and financial institutions, Bitcoin operates on a peer-to-peer network without any central authority. This has led to a more transparent and secure system that is appealing to many investors.

Another factor to consider when comparing the market cap of BTC to traditional financial markets is the volatility of Bitcoin. The price of Bitcoin can fluctuate dramatically in a short period of time, which can be both a blessing and a curse for investors. While the potential for high returns is attractive, the risk of losing money is also significant.

Overall, the comparison between BTC market cap and traditional financial markets highlights the growing influence of cryptocurrencies in the global economy. As more people turn to digital assets like Bitcoin, it is important to understand the implications for traditional financial markets and how they can coexist in the future.

This article is important for understanding the evolving landscape of the financial world and the impact of cryptocurrencies like Bitcoin on traditional markets.